Warehouse Rent Calculator

Enter your warehouse details to calculate rental costs.

Looking for a warehouse and wondering how much you’ll actually pay? In 2025 the typical cost has nudged up to about average warehouse rent US $8.70 per square foot per year, but the number flips dramatically depending on where you set up shop.

Key Takeaways

- National average rent sits around $8.70/sqft/yr in 2025.

- Coastal metros like Los Angeles or New York exceed $13/sqft, while the Midwest hovers near $6.

- Lease length, building class, and local labor costs are the biggest rent drivers.

- Working with a specialized industrial real‑estate broker can shave 5‑10% off quoted rates.

- Tracking CPI and e‑commerce demand helps you predict rent spikes before they hit.

What Exactly Is "Warehouse Rent"?

Warehouse rent is the periodic payment a tenant makes to occupy industrial space, typically expressed as dollars per square foot per year. It covers the right to use the building, but not always utilities or property taxes - those are often bundled into a Triple Net (NNN) lease.

How Is the Rent Figure Calculated?

Two numbers matter most: the total square footage (the amount of usable floor space measured in square feet) and the price per square foot. Multiply them together, then multiply by the lease term in years to get the total cost. For example, a 20,000‑sqft warehouse at $9/sqft for a 5‑year lease works out to $900,000 over the term.

Typical Lease Terms and What They Mean for Your Budget

Most US leases run 3‑10 years. Longer terms usually lock in a lower rate but reduce flexibility. Shorter deals can be pricier because landlords want to recoup their investment quickly. A Triple Net lease (a lease where the tenant pays rent plus property taxes, insurance, and maintenance) is common for warehouses - it pushes more cost responsibility onto the renter.

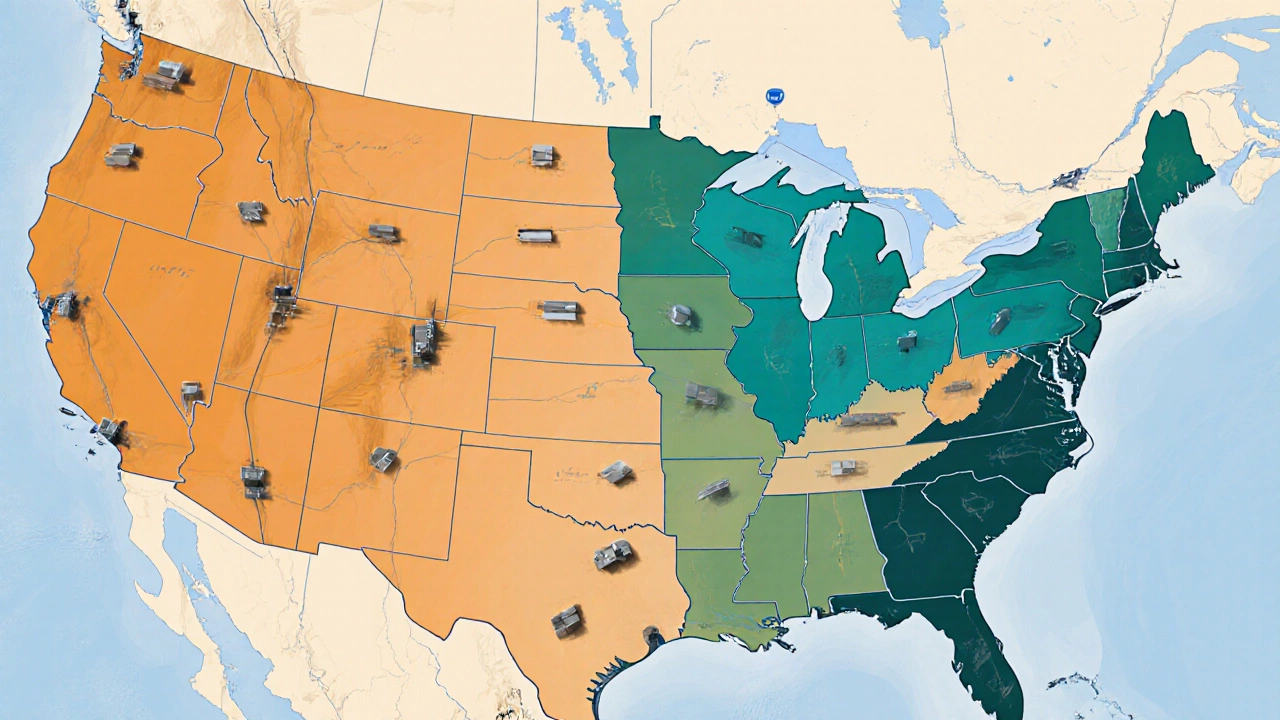

Regional Rent Snapshot (2025)

| Region | Avg Rent ($/sqft/yr) | Typical Lease Term (years) | YoY Change (%) |

|---|---|---|---|

| West Coast (e.g., LA, San Francisco) | 13.2 | 5‑7 | +4.1 |

| East Coast (e.g., NYC, Boston) | 12.5 | 4‑6 | +3.8 |

| Midwest (e.g., Chicago, Indianapolis) | 6.3 | 6‑10 | +1.9 |

| South (e.g., Dallas, Atlanta) | 7.9 | 5‑8 | +2.5 |

| National Avg | 8.7 | 5‑9 | +2.8 |

Notice how coastal metros charge roughly double the Midwest. The gap reflects higher land values, tighter zoning, and stronger demand from e‑commerce fulfillment centers.

Top Factors That Push Rental Prices Up or Down

Understanding what moves the needle helps you negotiate better.

- Location: Proximity to highways, ports, and major population centers adds premium. Location (the city or metro area where the warehouse sits) can add $2‑$5 per sqft.

- Building class: Class A (new, climate‑controlled) commands the highest rates; Class C (older, basic shells) is cheapest.

- Market trend: The market trend (year‑over‑year change in average rent percentages) has been positive since 2020, driven by surging online shopping.

- Labor costs: Areas with higher minimum wages often see landlords raise rent to cover operating expenses.

- Consumer Price Index (CPI): A CPI (inflation measure that many leases tie rent escalations to) increase of 3% usually triggers a similar rent bump.

- E‑commerce demand: When online retailers expand fulfillment networks, they hunt for close‑to‑customer warehouses, pushing rates up. e‑commerce demand (the volume of online retail orders that need storage and shipping) grew 12% in 2024, a key rent driver.

How to Find the Right Warehouse Without Overpaying

Here’s a quick cheat‑sheet you can follow:

- Define your required square footage based on current and projected inventory levels.

- Map out the ideal locations - think of your biggest customer clusters and major transport routes.

- Contact an industrial real‑estate broker (a specialist who matches tenants with warehouse space and negotiates lease terms). They have access to off‑market listings and can benchmark rates.

- Request a rent break‑down: base rent, NNN charges, and any escalations tied to CPI.

- Compare at least three properties using the same metrics - total cost per sqft over the lease term.

- Ask for a rent‑free period or tenant improvement allowance; many landlords concede these to seal the deal.

Common Pitfalls and How to Avoid Them

Even seasoned operators slip up if they ignore the fine print.

- Ignoring escalation clauses: A 2% annual CPI increase looks modest, but over a 10‑year term it adds nearly 22% to the total cost.

- Underestimating NNN costs: Property taxes, insurance, and maintenance can total $2‑$3 per sqft, turning a $9 base rent into $12 effective rent.

- Over‑building flexibility: Signing a 10‑year lease for a space you might outgrow can force a costly sublease or early termination fee.

- Skipping due diligence: Check roof condition, loading dock height, and ceiling clearance - retrofitting these later can be pricey.

Next Steps If You’re Ready to Lease

1. Pull together your inventory forecast for the next 3‑5 years.

2. Rank the top three metros that balance cost and customer reach.

3. Reach out to a broker and request a rent comparison sheet.

4. Review the lease language with a commercial‑real‑estate attorney - focus on escalation, NNN, and early‑termination clauses.

5. Negotiate a rent‑free period or tenant‑improvement allowance before signing.

Frequently Asked Questions

What is the typical size of a US warehouse?

Most midsize operators rent spaces between 20,000 and 100,000sqft. Smaller businesses often start around 5,000sqft, while large distribution centers can exceed 500,000sqft.

How does a Triple Net (NNN) lease affect total cost?

In an NNN lease the tenant adds property taxes, insurance, and maintenance to the base rent. Those extra charges usually run $2‑$3 per sqft annually, so a $9 base rent can become $11‑$12 effective rent.

Can I negotiate the CPI escalation rate?

Yes. Many landlords will cap the annual increase at 3% or tie it to a specific index. Getting that written into the lease can protect you from runaway inflation.

Is it worth paying more for a ClassA warehouse?

If your operation needs climate control, high ceilings, or advanced dock equipment, the higher rent often pays off through lower operating costs and faster order fulfillment.

What role do industrial real‑estate brokers play?

Brokers have market data, access to off‑market listings, and negotiation expertise. Studies show tenants who use a broker save an average of 6% on rent and secure better lease terms.